There are many ways to get a loan. The loan can be for a variety of purposes, including debt consolidation, buying a home, paying for a child’s college tuition, or even a holiday.

Many people think that all loans need to be paid off in order to have it paid back, but this is not true. There are some loans that do not need to be paid back at all, so it is important to understand how the process works before you start applying for one.

Personal Loan

Personal loans can be obtained from most banks, financial institutions, and even online lenders. Of course, most do not require collateral to be given. This is unlike a mortgage or car loan, both of which are backed by home and auto, respectively.

Typical personal loans have short-term repayment terms, which are much like terms offered on larger loans. These repayment terms can last anywhere from three to five years, depending on how many payments are due on the loan. If the borrower does not make the payment on the loan, the interest will continue to build, making it easier to accumulate debt. In addition, if you default on a loan, your credit rating will suffer.

Home Loan

Home loans can take longer to pay off because the property itself may require some repairs. Homeowners who have to pay for repairs or renovations on their home will be required to make extra payments on the loan.

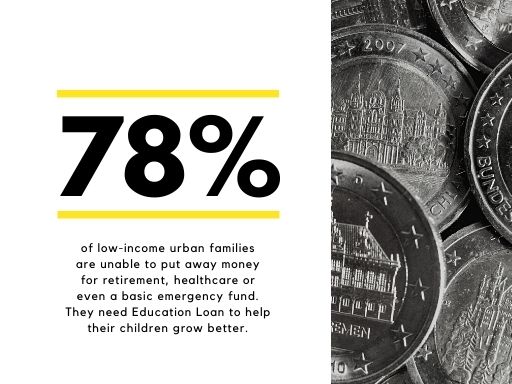

Education Loan

An education loan is very similar to a personal loan. The only difference is that an education loan is only for individuals, whereas a personal loan can be used by individuals and couples alike. A student loan is also very similar to a personal loan. Students can use the funds to pay for school, and then use the loan funds to pay off their tuition and fees.

An education loan can also be used for tuition, room and board, books, lab fees, as well as any travel expenses. A home loan is a little different because the loan is used to purchase a home. You must first own home before you can apply for a home loan.

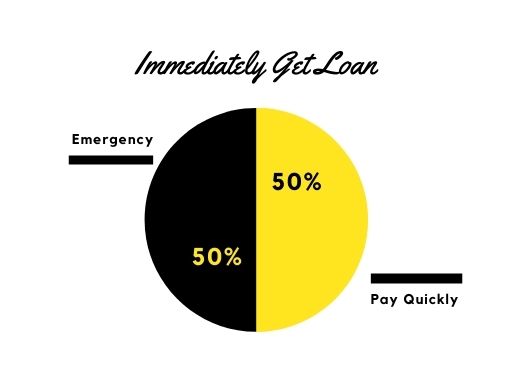

Payday Loan

Another type of loan is called a payday loan. With this type of loan, the lender will issue a loan to a borrower on the same day the borrower needs the money. These types of loans are often for immediate financial needs and do not have to be paid back until later in the future. Usually, the interest rates are higher than other types of loan rates.

Although a person with good credit can get a loan, the loan approval process can be difficult. It may take many applications to find one that you are approved for.

Credit Cards

Having good credit is important when it comes to a loan because lenders look at how much you owe, how long you have been paying off your loans, and if you have filed for bankruptcy or have defaulted on your credit cards. It is also important to have a good credit history when looking for a new job.

When searching for a house to buy, it is helpful to know the different types of loans available to you. For example, most people will be interested in buying a new home, whether it be a single-family home or a condominium unit. A mortgage is a common type of loan. The amount that you pay on the loan is based on your credit score and usually depends on the type of loan.

Auto Loan

Car loans are different than a mortgage because instead of taking a loan out, you are borrowing money to buy a car. The type of car you buy will determine the interest rate on the loan. Sometimes, you are able to borrow more than the actual value of the car.

There are some other types of loans such as a credit card, a cash advance, a payday loan, and a car title loan. These types of loans do not require a down payment, but the interest rate and payments can be very high.

How will I get a business loan if I am earning from YouTube?

Kindly, approach any nearby bank.

Can we get credit card if we are earning through Adsense?

If you file an ITR then it is easy to get a credit card.

Can I get a personal loan if I file an ITR?

Pretty easily. Approach any nearby bank.

Superb post.